Well, look, when it comes to this whole CDD and EDD business, it’s really about who’s who and what’s what with the money, right? Folks say these banks and companies, the ones handling money, got to know exactly who they’re dealing with. They call it Customer Due Diligence (or CDD) — but really, it just means they’re double-checking who’s on the other side of the counter before any deals are done. Now, this ain’t about just a name and a face; no, they need all sorts of things like addresses, IDs, and maybe even what folks do for a living.

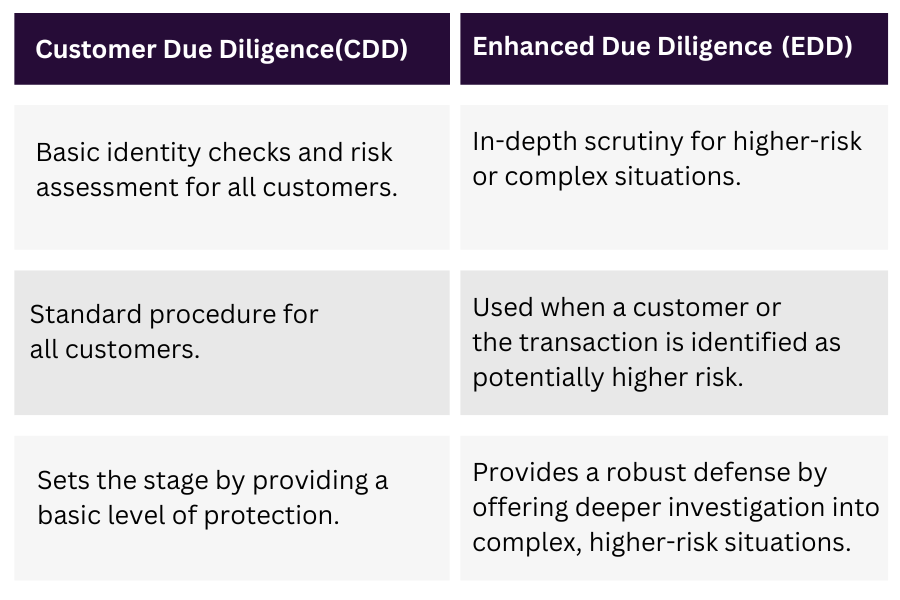

CDD is the first step, plain and simple. Banks got to make sure whoever’s handling the money ain’t up to no funny business. It’s just good sense, really. They want to know things like, “Who’s this person in front of me? Where they from? Is their story lining up with their paperwork?” So, the banks check all that out, down to the smallest details. It’s a bit like a handshake deal back in the day — only this time, it’s a paper trail.

Now, sometimes, CDD ain’t enough. There’s times you need to go deeper, and that’s where Enhanced Due Diligence, or EDD, comes in. This EDD business digs right into the nitty-gritty. If things look fishy — say a big pile of cash suddenly shows up in someone’s account — then EDD’s gonna be the one to take a good, hard look at it. They look at where the money came from, where it’s going, and maybe even why it’s moving in the first place.

- CDD – Checking the basic info: name, address, ID, and so on.

- EDD – A step deeper, looking into why money’s moving and where it’s coming from.

Now, banks and financial institutions can’t just ignore these checks — they’re actually required by law in a lot of places. They got these rules so money laundering and other shady business don’t slide under the radar. Think of it like this: if someone’s hiding something or up to no good, well, CDD and EDD are there to sniff it out.

One thing that CDD and EDD do pretty well is protect regular folks from scams and tricks. Banks keep an eye out, watching for anything that doesn’t smell right. That’s how they stop money launderers — those folks who try to sneak dirty money through clean accounts, like putting on fancy clothes and pretending to be somebody else. CDD and EDD catch them in the act, making sure they don’t get far.

All in all, with these CDD and EDD processes, banks make sure money’s moving the right way, with the right folks, and for the right reasons. These rules aren’t just there for show; they’re actually like a set of guardrails for financial institutions. If they didn’t have these checks, well, then who knows what kind of tricks people would try pulling with other people’s money? So in the end, CDD and EDD keep things on the up and up, making sure that when money’s moving, it’s moving safe and sound.

Tags:[CDD, EDD, Customer Due Diligence, Enhanced Due Diligence, financial regulations, anti-money laundering]