What is RFC and Why Do You Need It in Mexico?

Well, let me tell ya, if you’re living in Mexico or planning to do business here, you’re gonna need somethin’ called the RFC. That’s short for Registro Federal de Contribuyentes, which is a fancy way of sayin’ Federal Taxpayer Registry. In simple words, it’s a number they give you so the government knows who you are, and when it’s time to pay your taxes, they’ll know exactly how much you owe.

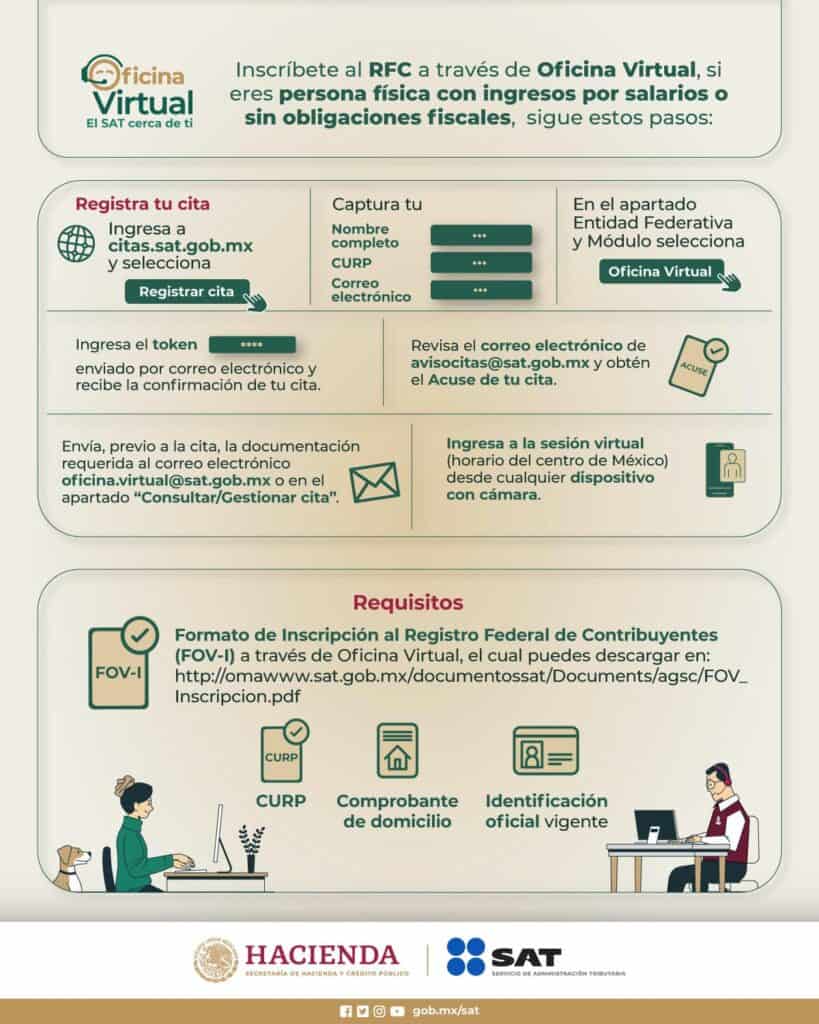

How to Get Your RFC?

Now, don’t go thinkin’ it’s some big complicated thing. Nope, it’s actually pretty simple to get, and you can do it all online! If you got yourself a little computer or a phone, you can head on over to the SAT website (that’s the tax office in Mexico) and follow their steps to get your RFC. Just like that, you’ll be part of the system!

- First, you gotta head over to the SAT’s website. Look for the option that says “Obtain your RFC with the Clave Única de Registro de Población” (that’s just a big name for a special ID number they gave ya when you were born or when you got your residence here).

- Fill out the form with your details. Don’t worry, it ain’t hard! Just put in your name, address, and a few other bits of info. Then, they’ll give you your RFC number.

- Once you’re done, you can download your official certificate with your new RFC number, and there ya go. You got yourself your tax ID!

Do You Need It for Just Business or Everything?

Now, you might be wonderin’, “Do I need this RFC if I’m not a business owner?” Well, let me tell ya, it don’t matter if you’re workin’ for yourself or for someone else, you still need this number. Even if you’re just a regular employee, your boss needs to know your RFC so they can deduct the right amount of taxes from your paycheck. You see, it’s all part of the system to make sure everyone’s payin’ their fair share.

How Does This Affect Companies Like DiDi in Mexico?

Now, you know how there’s a whole bunch of taxi apps nowadays? Well, one big player in the game is DiDi. They’re a ride-sharing company, kinda like Uber, and they’re pretty popular here in Mexico. In fact, they’ve been doin’ so well that they passed Uber to become the top ride-sharing app in the country in 2022!

So, what does that have to do with RFC? Well, let me tell ya, even big companies like DiDi gotta make sure they’re registered with the SAT and have their RFC in order. If they don’t, they won’t be able to operate in the country, and we sure wouldn’t be able to catch a ride when we need one, right? All the drivers that work with DiDi, they gotta have their own RFC too, because without it, they can’t legally collect their pay and do business properly.

What Happens if You Don’t Have an RFC?

If you try to go through life without gettin’ your RFC, well, let’s just say things won’t be too easy. For one, you won’t be able to get your paycheck correctly, and if you ever need to file taxes (and trust me, they come around once a year), you’re gonna have a hard time doin’ that without it. Plus, the government might come knockin’ at your door askin’ why you ain’t registered. Ain’t nobody got time for that!

Conclusion

So, to wrap it up nice and tight, if you live or work in Mexico, you need an RFC. It’s like your tax ID number, and you gotta have it to do business legally, work with companies like DiDi, or even just to get your paycheck. Lucky for us, gettin’ it is easy, and you can do it all online. Just go to the SAT website, fill out the form, and boom—you’re all set!

Tags:[RFC, Mexico Tax, SAT, DiDi, Ride Share, Taxpayer Number, Mexican Taxes, DiDi in Mexico, How to Get RFC]